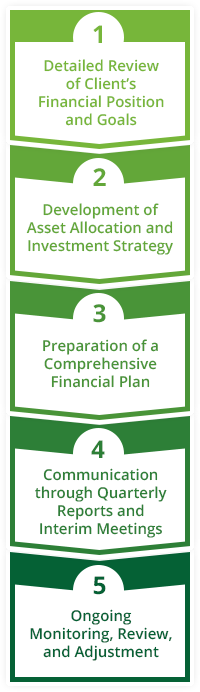

We take a holistic approach to serving our clients’ investment management and financial planning needs so they can achieve their long-term financial goals.

Our process begins with a comprehensive review of a client’s current financial position and investment objectives. In addition, we evaluate each client’s overall risk tolerance, investment time horizon, and need for income. Based on this review, we develop a personalized investment strategy designed to meet those needs and objectives.

A fundamental decision in this process is the proper asset allocation between equities held primarily for long-term appreciation and income investments held principally for current income. Most clients have some balance between the two.

We also employ strategies for maximizing tax efficiency, including purchasing high yielding income securities in tax-deferred accounts such as IRAs and equities held for long-term appreciation in taxable accounts, if possible. This attention to individual security location as well as overall asset allocation is an important feature of our investment management approach. Towards the end of each tax year, we also offset realized gains by harvesting select losses, when available, in individual client portfolios in an effort to maximize tax efficiency.

We report regularly to our clients through quarterly reports and interim meetings, and we monitor and adjust portfolios regularly to ensure that they remain appropriately balanced to meet each client’s needs and objectives.

The opinions expressed herein are those of Edgemoor Investment Advisors, Inc. (Edgemoor) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to sell any product. You should not assume that any of the investment strategies or securities discussed here are or will be profitable. Edgemoor reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.